Forex market hour have several trading session in which you can trade and make money. This time depends on what is the current time in the world and when you are awake if you trade manually.

While there is several trading centers in the world and there is traders from all around the world you can find buyers and sellers on Forex market all the time, 0-24 h, from Monday to Friday.

But have in mind that Forex market is not volatile 0-24h as it can be in the best trading hours. Which Forex market hours are the best for trading you can find further in this post.

Contents

Forex Trading Sessions

Forex market is open 24 hours a day but it is not good to trade whole day. Why it is not ok to trade whole day? Because you need to rest, first of all, and there will be time in a day when market does not move. Without market movement you cannot earn money.

When market is steady and going sideways, not going up or down, you will have hard time to earn some money. On the chart market will move sideways or it will have few pip movement in each candle.

It is not impossible but it will be harder then usually.

Lets see how market behaves in different time of the week and day.

Forex Market Hour Trading Session

There is four major trading center in the world which are spread around the globe. They are Tokyo, Sydney, London and New York.

Tokyo is for Asian time, Sydney for Australia time, London for Europe time and New York for U.S.

When the Forex market open and close in those cities depends on the local business hours. Maybe you guess that Forex market hours are between 07:00 -09:00h up to 16:00-17:00h? You are right.

Forex Market Hour (local hour)

Since four cities are scattered on the globe you will have overlap between two trading sessions. Tokyo and London session, London and New York session.

When this overlap happens there will be increase in trading volume because more traders are active and news from both trading session will be available to trade.

MetaTrader Chart – Trading Session Overlap

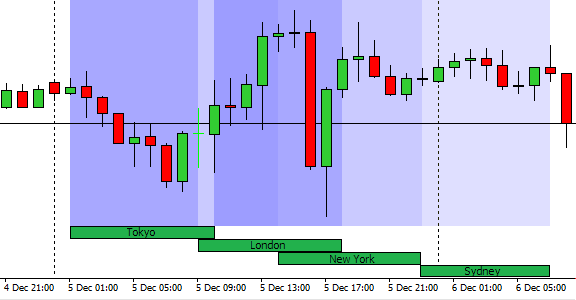

On the picture below you can see how does market looks like on MT4 trading platform during four trading sessions. Starting the day with Sydney and Tokyo Forex market hour you can see that there is some volatility. When London trading session opens with overlap on Tokyo trading session candle becomes larger while there is more traders active.

In the middle of the day volatility increases and around 13-14h New York traders jumps in and make larger volatility. This is seen as large candles, first red and second green.

London and New York Forex market trading session overlap makes highest jumps on the Forex market because those are two largest trading center. During this overlap most traders are active and news in U.S. are coming out which impacts whole world and all currencies.

During Forex market hours each trading session have different impact on the currency pair because not all currencies are important for traders. Major Forex Currencies and that are connected with currently active trading center have more volatility. Also banks have large impact on each currency so when bank(FED) for U.S. dollar is open you can expect more volatility.

For Sydney and Tokyo Forex market hour trading session AUD, NZD and JPY currency will have more volatility. For Europe EUR, GBP, CHF and for New York USD will have higher volatility.

Market Average Pip Movement

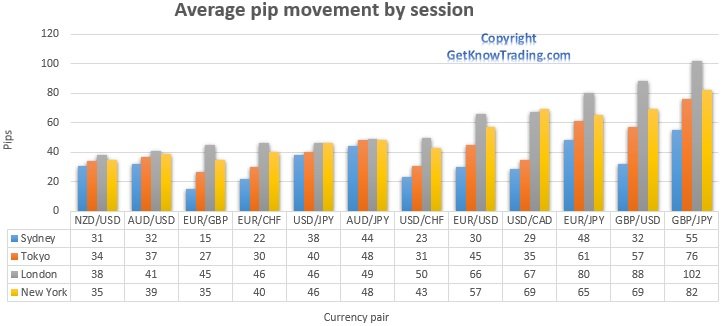

To understand how active trading session is during Forex market hours here is a list of the average pip movement during that period. On the chart data is extracted from yearly data collection of pip range, 12/2017-12/2018 .

Trading session pip range -comparison

As you can see largest movements is during London session. Also, you can see that EUR/USD, GBP/USD and JPY pairs have highest trading movement during Forex market hours.

If you take a closer look you can see that in Tokyo and Sydney trading session AUD and NZD with JPY currency have higher volatility compared to another currency pair, as for example EUR/GBP. Reason for this is that Europe is sleeping during these Forex market hours and traders from Europe do not contribute to the market volatility.

But those pairs have smaller volatility during London and New York trading session compared to other trading pairs like EUR and GBP crosses. Traders are focused on major pairs like EUR, GBP and USD.

On the right side of the chart you can see that JPY pairs have highest volatility. JPY pairs with largest volatility are those that includes EUR, USD and GBP currencies.

Volatility is highest during London and New York Forex market hours when major currencies are mostly traded. Reason for this is that JPY pair is widely traded on Forex market and almost 1/5 of trading transactions are made with this currency.

Table shows average data and use it just as overview how much is average movement. Movement depends on several factors which could not be included in this set of data.

Forex Market Hour – Tokyo Trading Session

Tokyo session is financial capital of Asia in Forex market and it is third largest Forex trading center in the world. This is visible by how much Japanese Yen is traded on the chart of average daily movement. By some measurements Yen covers around 16% of all Forex transactions and 21% of transactions are done during these Forex market hours.

During this session you could expect slow trading pairs movement. One that could move faster is AUD/USD, NZD/USD or AUD/NZD which are close connected to that part of the world. This volatility is visible on the chart above.

What could impact movement is news that comes from Japan, Australia, New Zealand and China. News are connected to those currencies and high amount of goods exchange is done between those countries. Due to high goods exchange any news on country economy will have impact on the currency of that country and currency of the other countries.

Forex Market Hour – London Trading Session

Finishing Tokyo trading session European traders starts to warm up. London is trading center with history in Forex market so every one is paying attention on it. Around 30% of Forex transactions is done during London trading session.

London have high liquidity and during this period you can expect lower spread on currency pairs. Also, trends that forms during these Forex market hours will likely continue until New York trading session start and possibly to end when traders decide to close their position to take out the profit.

Volatility can slower down on London trading session in middle of the trading day because traders have a brake during lunch time. After lunch they wait for New York Forex market hours to start and news are published which have large impact on the market.

There is many pairs to trade during these Forex market hours because two major trading sessions overlap. It is best to stick to major pairs who have smaller spreads and higher volatility. Also major pairs will be influenced by news coming from Europe and America and movement will be visible.

Forex Market Hour – New York Trading Session

New York trading center is major one in U.S. like London and Tokyo in their part of the world. After lunch in London trading session here Forex market hours are started and news starts to come out.

Higher liquidity is seen in the morning Forex market hours when overlap is active with London session and news are released.

News on New York session have huge impact on the Forex market because 85% of all trades include U.S. dollar. So when news about U.S. dollar i released you can expect major movements on many pairs crossed with U.S. dollar.

Forex Market Hours – Best Time to Trade

During Forex market hour overlap between London and New York trading session it is the best time because of high volatility. News is coming out on New York trading session that involves U.S. dollar who is in 85% transactions on the Forex market.

During London-New York trading sessions most traders in two largest trade centers in the world are focused on trading. This brings a lot of opportunities for any trader on the market.

Trends are forming which could last to the end of the day but also even longer time over a week.

At the start of the Forex market hours market volatility is not so active and remains steady until 08-09h o’clock in the morning. At this time London trading session traders jumps into market.

On the EUR/USD chart is visible that around noon there is lower action due to lunch time in London and market participant are preparing for New York session to open.

After news in New York is published market starts to become more active. This is visible by increased pip range on the chart around 14-17 h.

Going to the end of the day market becomes slower and returns to starting volatility range. Main trading center, London and New York closes and majority of the traders finishes trading day.

For any trader this information is important to take pips out from the market as much is possible. Based on this information you plan trading strategy when to enter into market and take out as much pips is possible. Depending which Forex currency pair you are trading you will choose best Forex market hours.

For EUR, GBP and USD currency, London and New York trading session is the best time to trade and for AUD, NZD Sydney and Tokyo trading session is the best time to trade.

Best Day to Trade

When is the best day to trade during a week trading session is best to look what is pip range for specific trading pair at specific day. It gives rough overview how pair is doing through week, when is highly volatile which is crucial for traders.

If average pip range is high then this means that traders loves that trading pair and you should hop in and take opportunity and earn some pips.

Here is a list of the average pip range during a week trading sessions.

Weekly pip range 12/2017 – 12/2018

You can see data showing that best day to trade is from Tuesday to Thursday. At the start of the week pairs are gaining on volatility where traders opens their positions and by the end of the week pair volatility starts to decline. At the end of the week traders mostly close their positions to avoid any possible news impact over weekend.

Middle of the week is the best time because most of the traders is already in the trend, they are warmed up and they earn money.

What is the best currency pair with highest movement during a day is shown also. GBP/JPY is at the top followed by GBP/USD and EUR/JPY. On these pairs you can expect wider spread because they are cross pairs.

Conclusion

At the end it all depends which trading pair you have decided to trade and in which time zone you live.

Trading pair volatility is close connected to time zone when Forex market hour trading session is open. Trading time for you is close connected when you are awake.

But there is automated trading which can be set to trade at any time during Forex market hours which gives you chance to participate on any trading session.

For you it is the best to choose which trading pair is good for your trading strategy, pair with high volatility, low spread and when you are fresh(enough sleep, calm and ready to do some work).

Continue reading more about what is Forex which will help you learn how to start trading on the Forex.

FREE WORKSHOP

For beginners who does not know how and where to start with trading

In the workshop I will tell you

what steps to do in order

to transform yourself into a trader

0 Comments